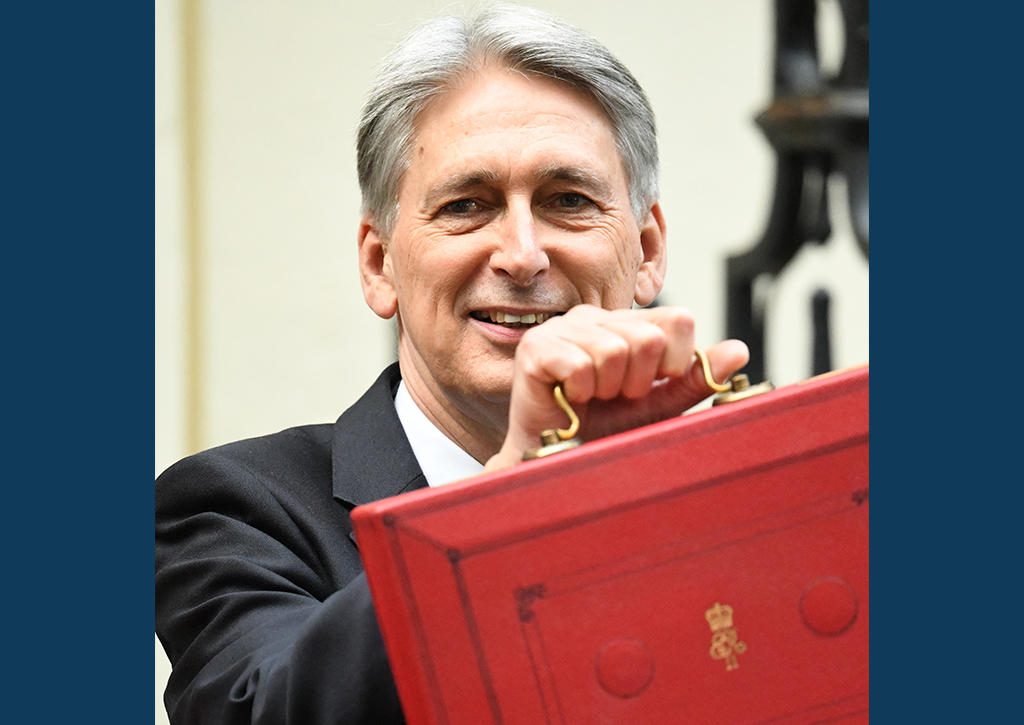

With Brexit and a potential election on the horizon, UK Chancellor Philip Hammond unveiled a generous Budget on 29 October 2018, aiming to give voters a warm sense of financial gain.

Alongside the headline announcement of a higher basic rate income tax threshold – delivering a marginal cash boost to around 32 million people – Hammond announced a string of measures to stimulate the residential property market.

Stamp Duty exemptions for shared home ownership purchases up to £500,000, backdated to the November 2017 Budget.

This decision corrects an anomaly from the earlier exemption, which meant that first-time buyers of shared ownership properties stood to pay full stamp duty on purchases, even if their own share was under the threshold.

“By their nature, first-time buyers purchasing shared-ownership homes are struggling to take that step onto the housing ladder,’ said Paula Higgins of the HomeOwners Alliance. She welcomed the move, and the decision to backdate it.

Other residential property experts argue that the move could prompt new activity from both developers and purchasers.

Non-UK residents will have to pay an extra 1 per cent in Stamp Duty in future. Full details of this change will be announced in January 2019.

The Help to Buy scheme will be extended to 2023, instead of ending in 2021.

This signals that the scheme has been relatively successful and popular, in contrast to many previous attempts to ignite the UK’s first-time buyer market in recent years. Nevertheless, there are fewer homes on the market than at any time since 2008 and mortgage applications are falling.

More high street shops and commercial buildings may turn into housing.

The Chancellor announced a £675 million fund to assist councils in reviving their retail districts, along with plans to make it simpler to convert commercial buildings into homes. The proposals were well received by the Federation of Master Builders, whose chief executive believes that up to 400,000 new homes could be created from unused space above high street shops.

‘We welcome the modernisation of the high street through initiatives such as the Future High Streets Fund which helps protect income and secure sustainable investment returns from retail holdings,’ said one property investment expert.

Non-resident property companies will come within the scope of UK Corporation tax from April 2020.

This will mean that these companies are likely to see a drop in their tax rates from 20 per cent to 19 and 18 per cent for financial years starting on or after 1 April 2020.

HM Revenue and Customs notes that: ‘This measure will deliver more equal tax treatment for UK and non-UK resident companies in receipt of similar income and take steps to prevent those that use this difference to reduce their tax bill on UK property through offshore ownership.’

There will be a new Capital Gains Tax payment window, with sellers having to make a payment on account within 30 days of when a residential property is sold. For non-UK residents this will apply from April 2019, and for UK residents from April 2020.

A new railcard will offer 33 per cent discounts for 20 to 30-year-olds

This measure aims to promote mobility among young people and could have an indirectly positive impact on residential property schemes in commuter districts, making it more affordable to buy homes.